A Modular, Personalized Cashback Experience Across Debit and Credit Products

CLIENT

Discover Financial Services

ROLE

UX Design / Creative Direction

TOOLS

Figma

Overview

Discover’s fragmented rewards experience—split between debit and credit portals—was confusing for users, lacked personalization, and missed critical opportunities to boost engagement with features like auto-redemption. Our objective was to reimagine the rewards ecosystem into a centralized, engaging, and modular Rewards Hub that could serve all types of users, from first-time redeemers to seasoned optimizers.

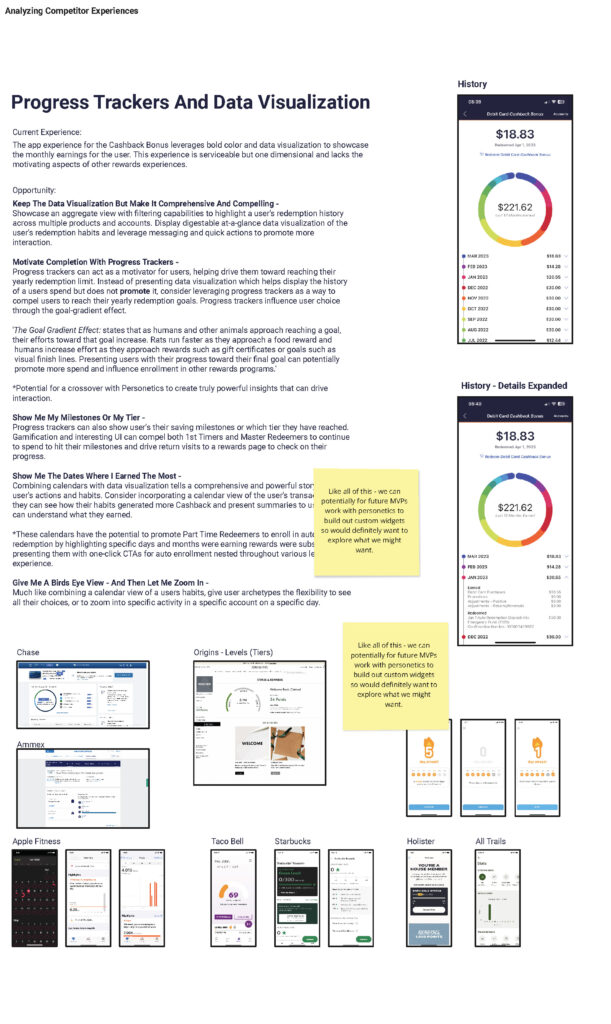

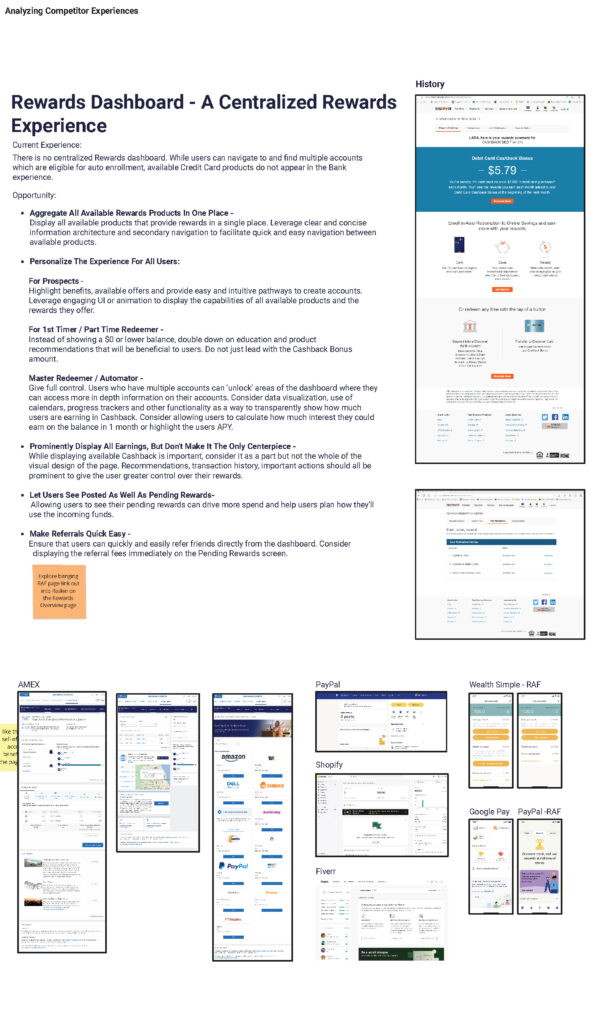

Research & Competitive Audit

We began with an extensive competitor analysis, segmenting user engagement tactics across industries such as fintech, retail, health, and education. These insights shaped both foundational UX flows and feature prioritization.

Key research themes

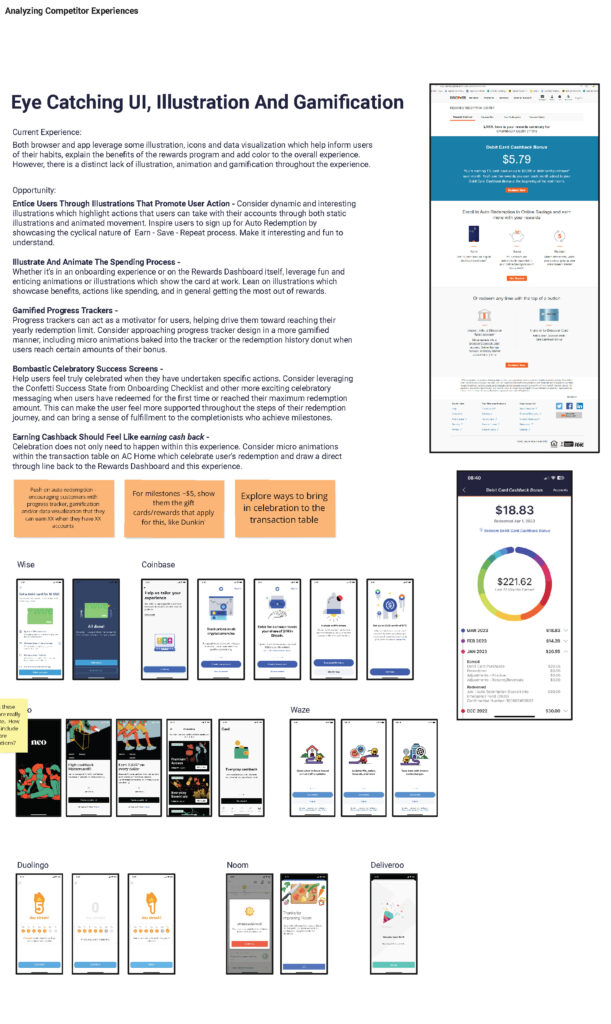

1.) Gamification & Progress Tracking

Duolingo & Apple Fitness: Introduced the “Goal Gradient Effect”—the concept that user motivation increases as they approach a goal. Applied as yearly rewards progress trackers and tier-based milestones in our hub, encouraging users to reach for the next cashback level.

2.) Micro-Celebrations & Visual Feedback

Coinbase, Noom, Deliveroo: Celebratory animations like confetti, sounds, and micro-messages proved to drive habit formation and reinforce positive action. Applied as animated success states, such as for enabling Auto-Redemption or hitting milestones.

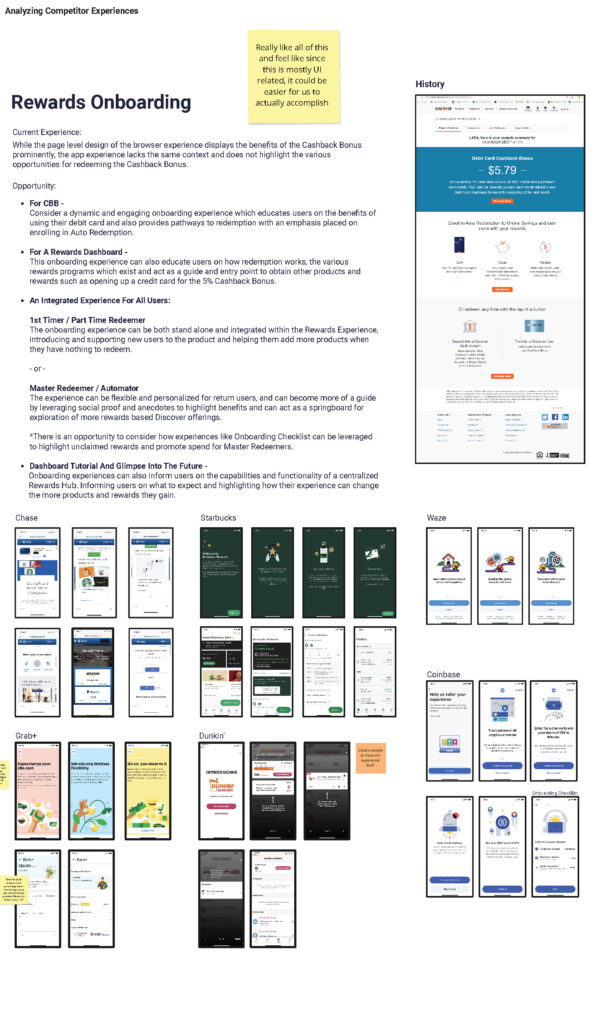

3.) Onboarding Personalization

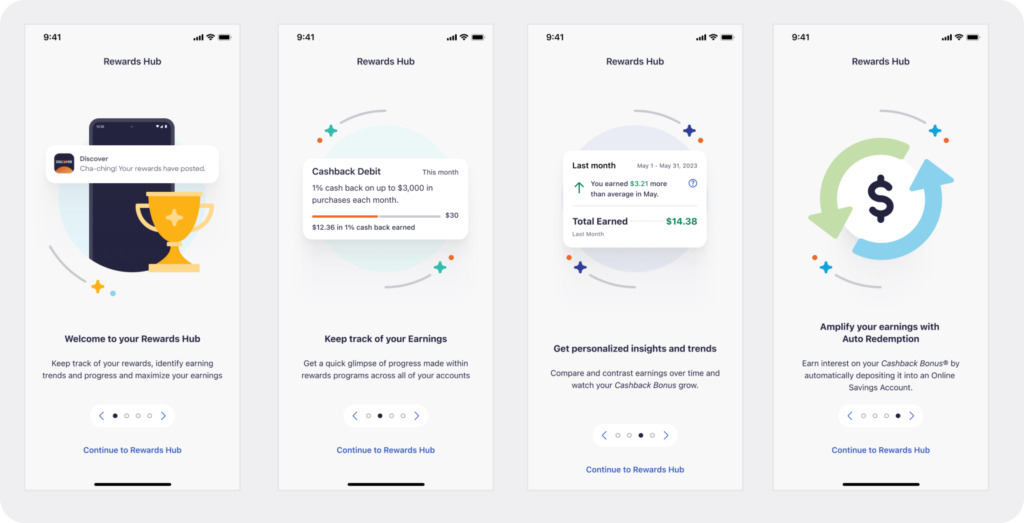

PayPal, Shopify, Waze: Contextual onboarding increased engagement and minimized friction by adapting entry paths to a user’s account state. Applied by segmenting onboarding into First-Time User, Unenrolled Auto-Redemption User, and Master Redeemer paths.

4.) Referral & Community Engagement

Wealthsimple, AMEX, Google Pay: Integrating referral functionality directly into the rewards flow increased acquisition and retention. Applied as prominent referral tiles with dynamic reward previews in the final dashboard.

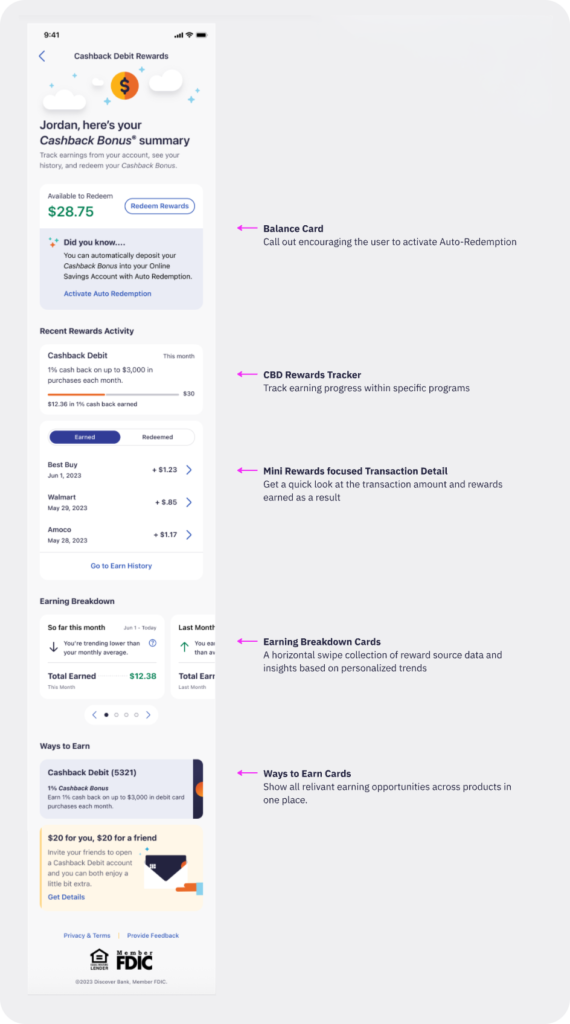

5.) Data Visualization & Behavior-Based Insights

Taco Bell, AllTrails, Personetics: Insightful visual breakdowns helped users understand how and when they earned rewards. Applied as a mini transaction detail sheet and calendar overlays showing peak earning days.

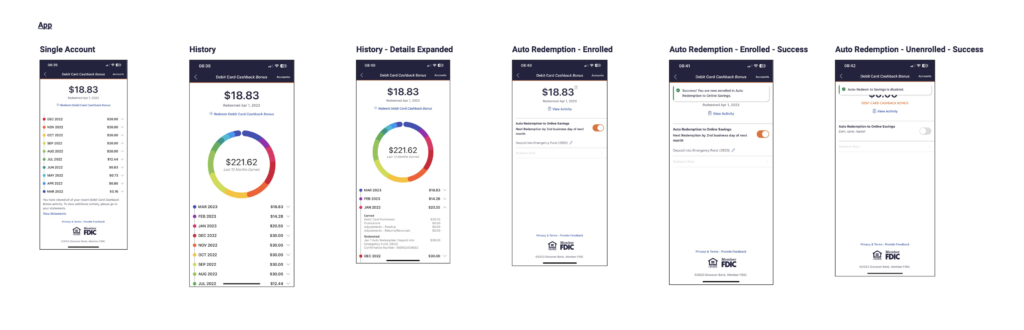

Existing Rewards System

Users could only view cashback bonuses on a per-product basis, with no integrated activity history to provide a complete picture of their rewards. As a result, rewards functioned as a buried sub-feature rather than a clear value proposition. The experience was further limited by minimal use of icons, color, and visual hierarchy, making it difficult for users to quickly understand or engage with their rewards.

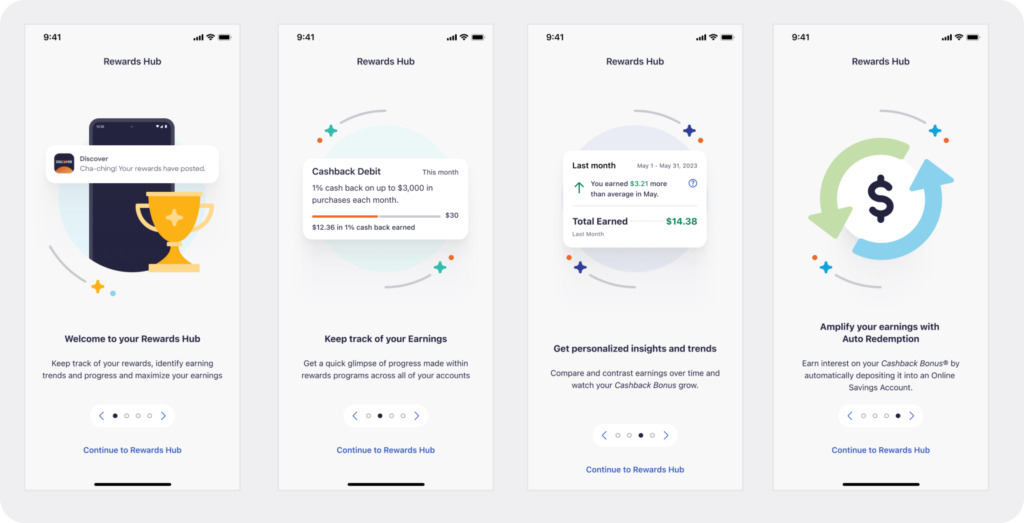

After UX/UI Overhaul

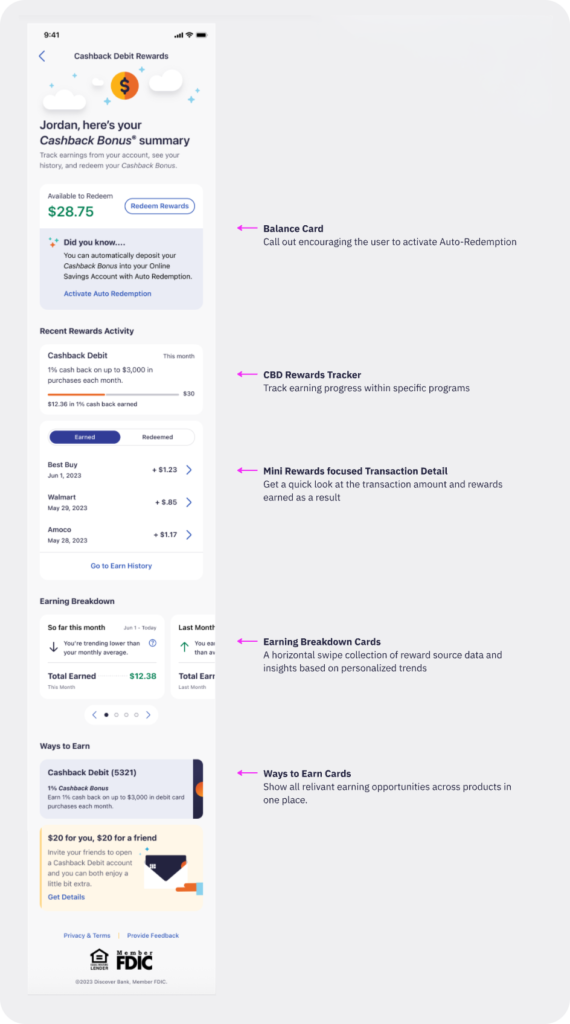

Rewards were unified into a centralized Rewards Hub that pulled data from debit, Discover it Card, and Chrome cards into a single, cohesive experience. Dynamic UI cards surfaced key information such as balances, auto-redemption status with clear activation CTAs, earning trackers, and mini transaction details. Personalized insight tiles highlighted meaningful moments—like peak earning periods or new 5% category activations—while micro-animations and illustrations added clarity and delight. Gamified tracker cards further motivated engagement by visualizing tier progress and prompting users to take action.

Functional Enhancements

The experience was enhanced with a set of functional improvements designed to drive engagement and clarity.

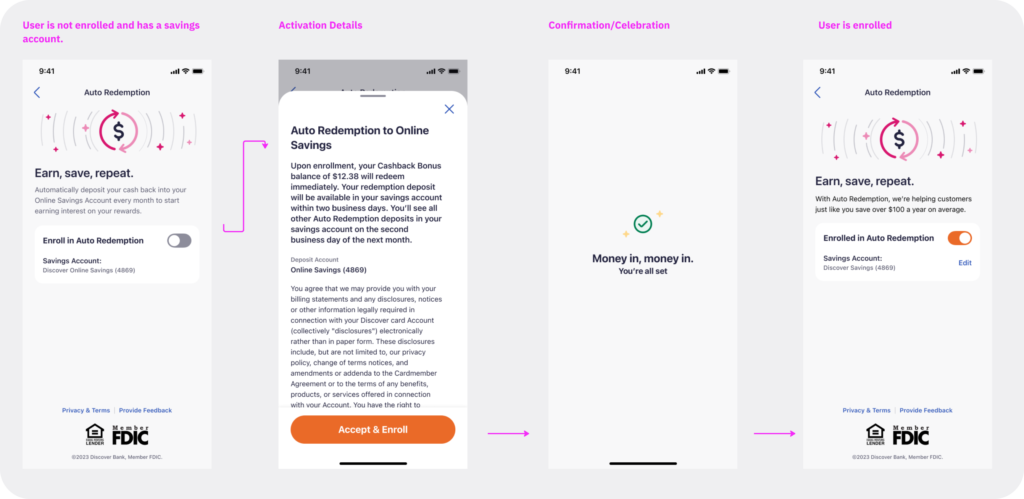

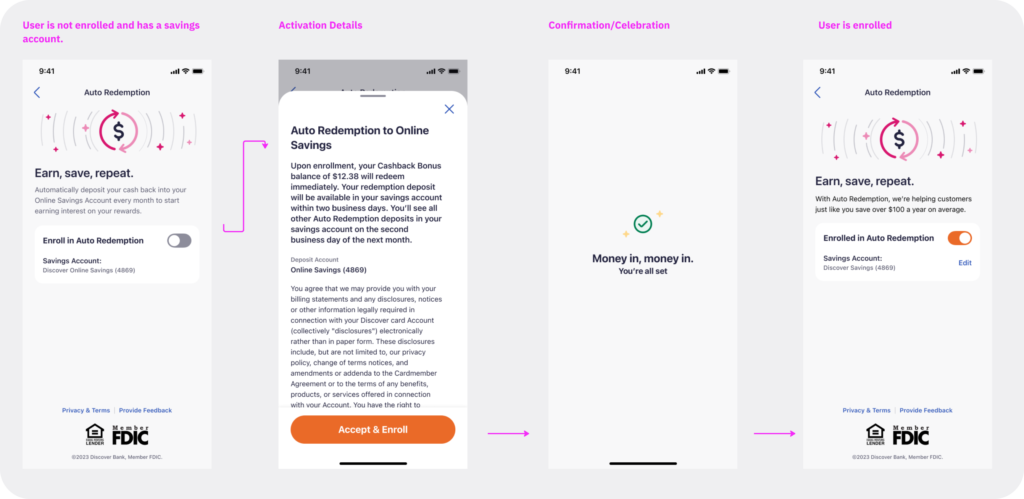

The auto-redemption flow was personalized based on whether a user had an existing savings account, with contextual nudges encouraging account creation when needed.

A redesigned 5% cashback activator introduced time-based notifications for new categories, replacing the previous legal-heavy calendar approach.

Insight-driven trackers leveraged spending data and filters (with planned Personetics integration) to surface meaningful progress, while celebratory micro-animations marked key moments such as first-time redemptions, tier milestones, and referral bonuses. Referral incentives were dynamically placed within reward tiles, adapting to user state and potential payout to maximize relevance and impact.

Functional Enhancements

The experience was enhanced with a set of functional improvements designed to drive engagement and clarity.

The auto-redemption flow was personalized based on whether a user had an existing savings account, with contextual nudges encouraging account creation when needed.

A redesigned 5% cashback activator introduced time-based notifications for new categories, replacing the previous legal-heavy calendar approach.

Insight-driven trackers leveraged spending data and filters (with planned Personetics integration) to surface meaningful progress, while celebratory micro-animations marked key moments such as first-time redemptions, tier milestones, and referral bonuses. Referral incentives were dynamically placed within reward tiles, adapting to user state and potential payout to maximize relevance and impact.

Results

The redesigned experience delivered a more scalable and user-centered rewards platform—one that reinforces a core reason Discover remains so popular with its customers. Improved modularity enabled faster product scaling and reuse, while a simplified onboarding flow reduced friction for first-time users. Contextual insights and thoughtful interaction design drove deeper engagement, and increased transparency across the experience clarified the value of the rewards system, strengthening user trust and highlighting rewards as a central driver of Discover’s appeal.