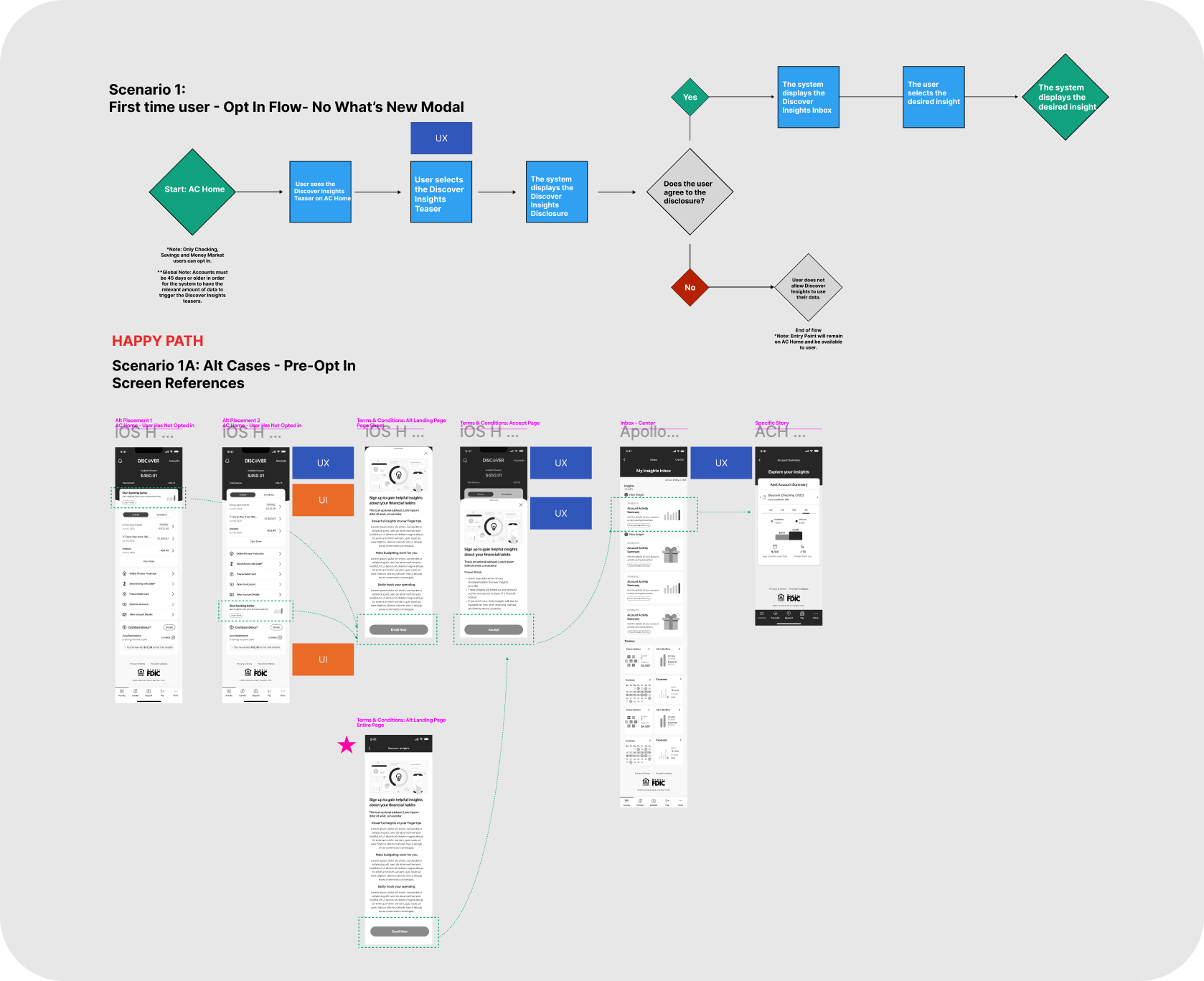

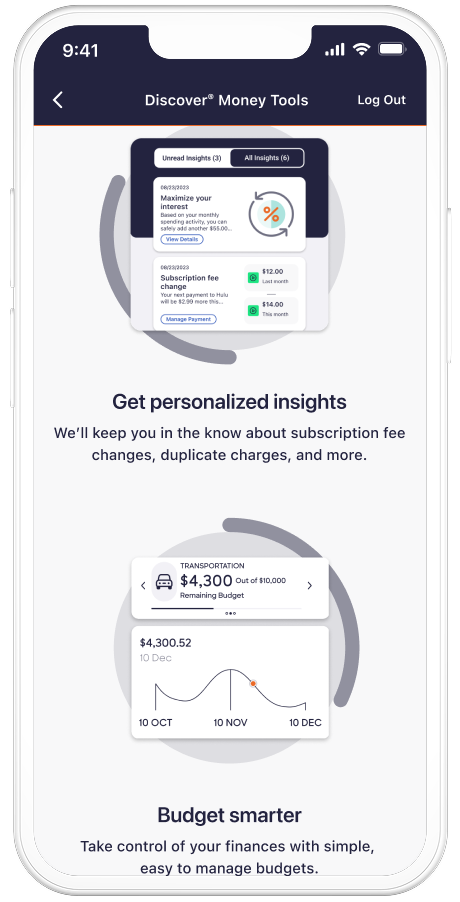

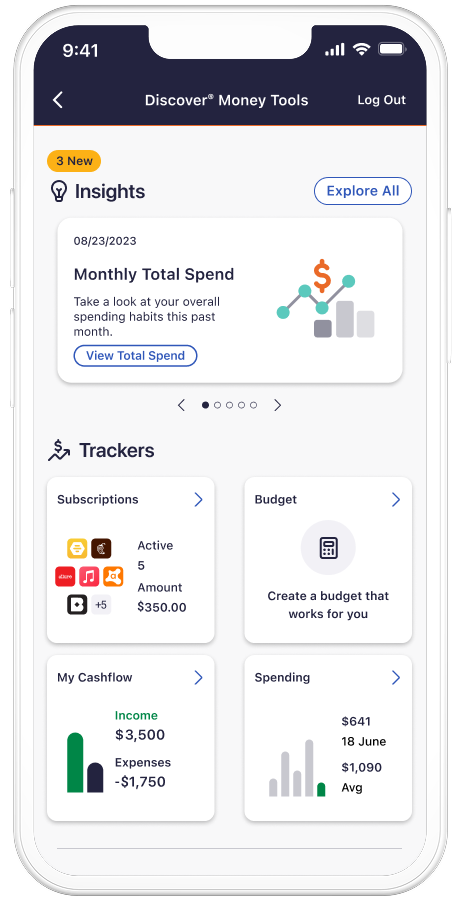

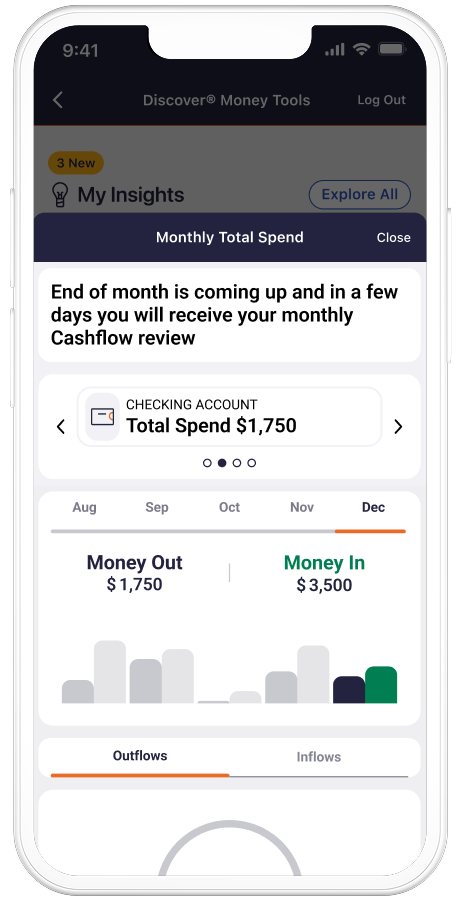

Unique Insights & Spending Trends Analysis

Highlights patterns in user spending to help make smarter financial decisions.

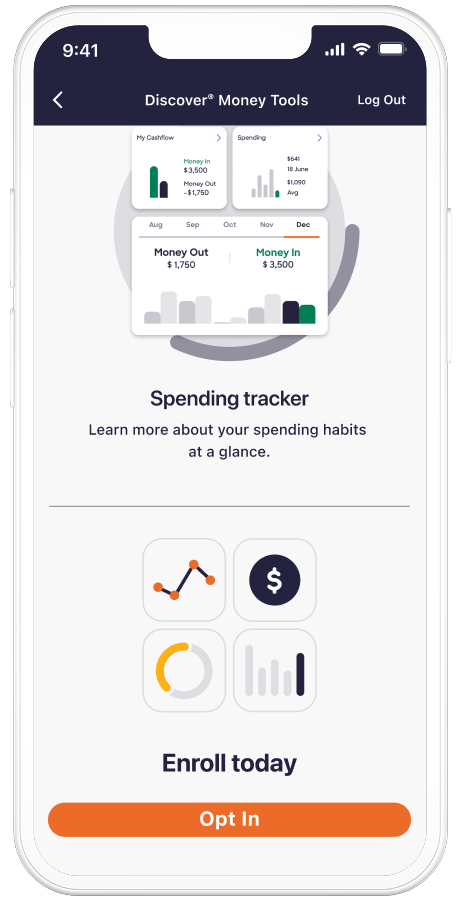

Budgeting Tool

Assists users in setting and tracking budgets across different categories.

Personalized Dashboard

Offers a unique, customizable dashboard where users can view all their insights, budgets, and financial tools in one place.

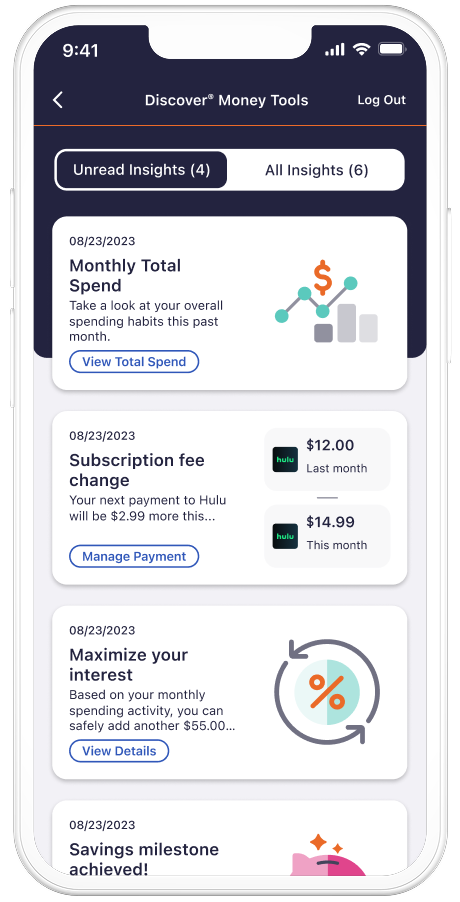

Insights Inbox

Provides a centralized location for alerts, notifications, and essential updates, enabling users to take immediate action.